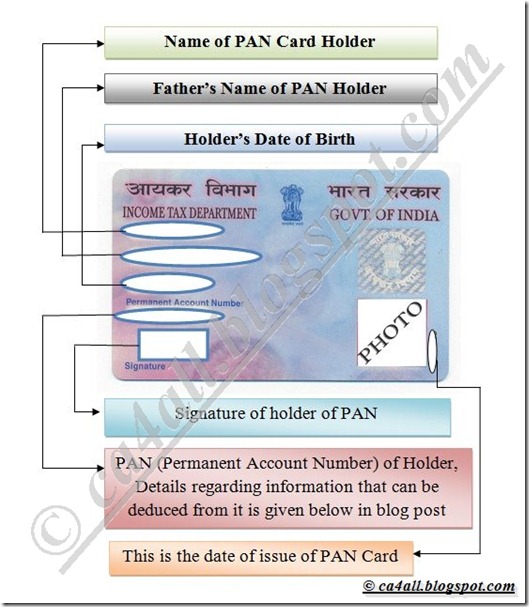

PAN or Permanent Account Number is unique alphanumeric combination provided to entities which are identifiable under the Income Tax Act, 1961.The basic purpose of assigning this number to an entity is to track down substantial flow of monetary resource to and fro through such an entity via this number. Hence, assigning this number and making its role mandatory in major financial transactions ensures that evasion of tax is checked. PAN also serves as an important Id proof document. PAN; as acronym depicts is “Permanent” and is unique to every entity. PAN is allocated to variety of “entities”, viz. Company, Individuals, HUF, Trusts, Societies, AOPs etc. Structure of a PAN Card is given below:

Permanent Account Number is framed in such a manner that it reveals some details about its holder, suppose the PAN is AAAAA9999A; Then,

- The fourth Letter in PAN tells us about the type of Assesse :

- A – AOP

- B – BOI

- C – Company

- F – Firm

- G – Government

- H – HUF

- J – Artificial Judicial Person

- L – Local Authority

- P – Person

- T – Trust

- Fifth letter of Permanent Account Number is :

- First character of Surname in case of Person

- First character of name for assesses other than a Person(Individual)

-

Next four characters “9999” in this case, are numbers ranging from 0001 to 9999

-

Last letter is “Alphabetic Check Digit”

Importance of PAN -

It is mandatory to quote PAN on return of income, all correspondence with any

income tax authority. From 1 January 2005 it will be mandatory to quote PAN on

chaalans for any payments due to Income Tax Department. It is also compulsory to quote PAN in all documents pertaining to the following financial transactions -

- Sale or Purchase of any Immovable Property valued at five lakh rupees or more;

- Sale or Purchase of a motor vehicle or vehicle, [the sale or purchase of a motor vehicle or vehicle does not include two wheeled vehicles, inclusive of any detachable side-car having an extra wheel, attached to the motor vehicle]

- A time deposit, exceeding fifty thousand rupees, with a banking company ;

- A deposit, exceeding fifty thousand rupees, in any account with Post Office Savings Bank;

- A contract of a value exceeding one lakh rupees for sale or purchase of securities;

- Opening a bank account;

- Making an application for installation of a telephone connection (including a cellular telephone connection);

- Payment to hotels and restaurants against their bills for an amount exceeding twenty-five thousand rupees at any one time ;

- Payment in cash for purchase of bank drafts or pay orders or banker’s cheques for an amount aggregating fifty thousand rupees or more during any one day;

- deposit in cash aggregating fifty thousand rupees or more with a bank during any one day;

- payment in cash in connection with travel to any foreign country of an amount exceeding twenty-five thousand rupees at any one time.

SEBI with effect from April 1, 2006 has made PAN card compulsory for opening a Demat account

nice

ReplyDeleteI just wanted to write down a simple note to say thanks to you for these precious ideas you are giving on this website. My extended internet look up has finally been recognized with sensible knowledge to share with my good friends. I would state that that many of us website visitors actually are really lucky to be in a really good community with so many special people with very beneficial points. I feel very much lucky to have encountered your entire webpages and look forward to really more pleasurable moments reading here. Thanks once more for a lot of things.Refer panseva to get any help in pan card

ReplyDelete